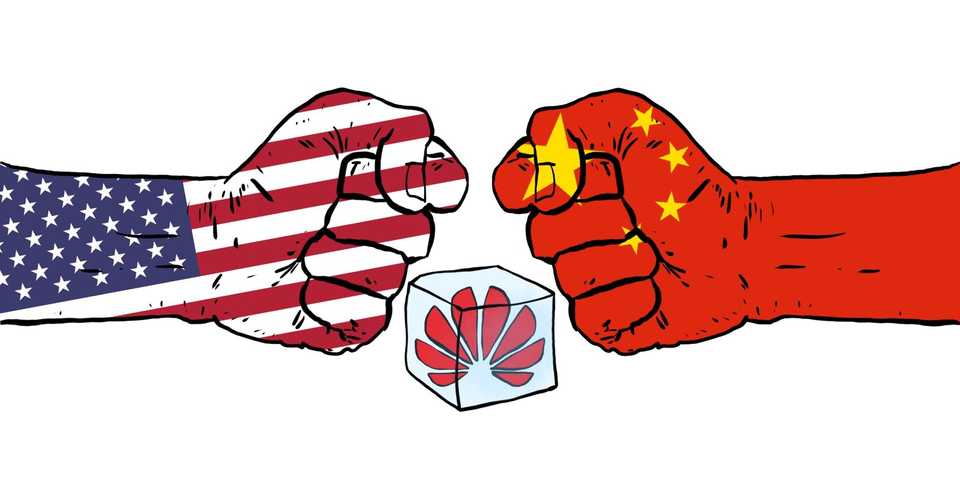

The China Tech Cold War From A Product Perspective

The ongoing U.S.-Chinese trade war represents a troubling reversal of decades of globalisation. One of the recent prominent victims is the Chinese company, Huawei. What do you do as a phone manufacturer when you are suddenly locked out of software like Android and components like advanced mobile processors? How can you compete and how should you respond?

Today’s lean canvas is a bit unusual. I will try to apply a tool designed to help validate products to breakdown the complicated politico-economic problem of the American-China trade wars and predict what will happen next. Lets get started.

Lean Canvas Takedown

The Problem

- Escalating tech trade war between America and China

- Western distrust of Chinese businesses

- Increasing prices of electronic consumer goods

- Loss of revenue for American businesses

One of the reasons we currently have a trade war between the U.S. and China is the economic argument of a trade deficit. Specifically the fact that America buys far more from China, resulting in a deficit expanding from ¢43.6bn to $419.2 in 2018.

Trump wants to cut back the deficit, and intends to use tariffs to do it.

Failed trade talks in May 2019 and increasing speculation of Chinese businesses spying on America has lead to a presidential order in May 2019 placing Huawei on the U.S. ‘entity list’. This means Huawei is limited to what businesses it can trade, buy, sell and work with.

Examples of this in action Google is blocking Huawei’s future access to Android updates, UK-based chip designer ARM has ceased all activities with the brand and multiple retailers/networks around the world suspending dealing with Huawei for fear of sanctions from the US government.

Customer Segments

- American Government & Businesses

- Chinese Government & Businesses

- Global consumers

Huawei, like all smartphone vendors, is still extremely reliant on U.S. suppliers for all parts of the microprocessor supply chain — from design to finished chips. There are no viable replacements in China today.

Not only will this hurt Chinese businesses trying to develop consumer electronics, but also U.S. component suppliers looking to sell into one of the biggest markets in the world. High-value components by definition entail very large research and development costs and significant capital outlays for their manufacture; that means that profit comes from volume, and losing a massive customer like Huawei would be costly.

However, the biggest losers overall will be us, the consumers. Prices are likely to go up in the short term, and competitive landscape for the smartphone market will ease up. There may be less economic incentive to innovate.

Solution

- Resolve the trade war

- Develop homegrown hardware and software solutions

- Build strong relationships with hardware producing countries

Resolving the trade war would be ideal, but trade wars are rarely fought over just economics. At the time of writing there does not seem to be a solution in sight.

For China a solution right now would be to become more independent with regards to advanced electronic manufacturing. The risk of relying on U.S. suppliers has been clear ever since the aborted ZTE ban in 2018, and this will only emphasise the importance of China building its own silicon supply chains in future. It is important to note that the United States is not the only advanced component manufacture, and that China should consider investing more in trading partners like South Korea, Taiwan, and Japan.

The US will need to start looking at alternative solutions to China for hardware assembly and logistics. This may come in the form of domestic assembly, but even with the aid of modern automation the economics of assembly still makes most sense abroad.

Unfair Advantage

- American advanced component manufacturing

- China’s access to rare earth metals

- Mutual access to consumer markets

If there was a time for American to play the trade war card, this is it. While tech devices like iPhones are “Made in China”, less than $10 worth of components originates there. The reality is that China is still relatively far behind when it comes to the manufacture of most advanced components like advanced processing chips. The best Huawei can do right now is stockpile supplies.

China does have one major card to play — rare earth metals. Though not actually ‘rare’, these 17 difficult to extract elements are an essential of component manufacture and China accounts for 90% of the global supply. The country imposed export quotas on exports of these in 2010 (later ruled illegal by the WTO) which sent prices skyrocketing, and it looks like something similar may happen again.

Finally, market restrictions. China is fairly famous for the banning and restriction of foreign products. Apple has taken special care to ensure access to the Chinese market, even going as far to create unique iPhones for the country resulting a significant source of revenue. China blocking apple and other electronic goods could hurt bottom lines significantly.

Likewise Huawei has been making significant strides into foreign markets with its consumer goods like phones despite US bans. It will be interesting to see if U.S. allies start taking a similar position to the states and start placing restrictions on Chinese electronic products and intellectual property.

Final Thoughts

From Adrian

The current trade wars are a product of the Trump administration, which for obvious reasons most people in tech are opposed to. Not only is Trump unpopular in Silicon Valley generally (which means his policies are), but these recent actions are potentially damaging for U.S. tech companies.

You could argue America threw the first stone in this trade war, but you need to remember China has been involved in anticompetitive practices restricting foreign businesses entering the Chinese market while actively supporting state funded or endorsed companies like Huawei for many years.

There are bigger problems countries need to be focused on solving than this, but economic pains and incentives are hopefully part of the process of getting there.

I believe increased interdependence between countries makes a safer planet. When it becomes more economically viable to buy and sell goods rather than fund wars to acquire them we all stand to benefit.